Imagine capturing the upside of the markets while simultaneously having large insurance companies protect your principal and any past gains from down markets. How does it work?

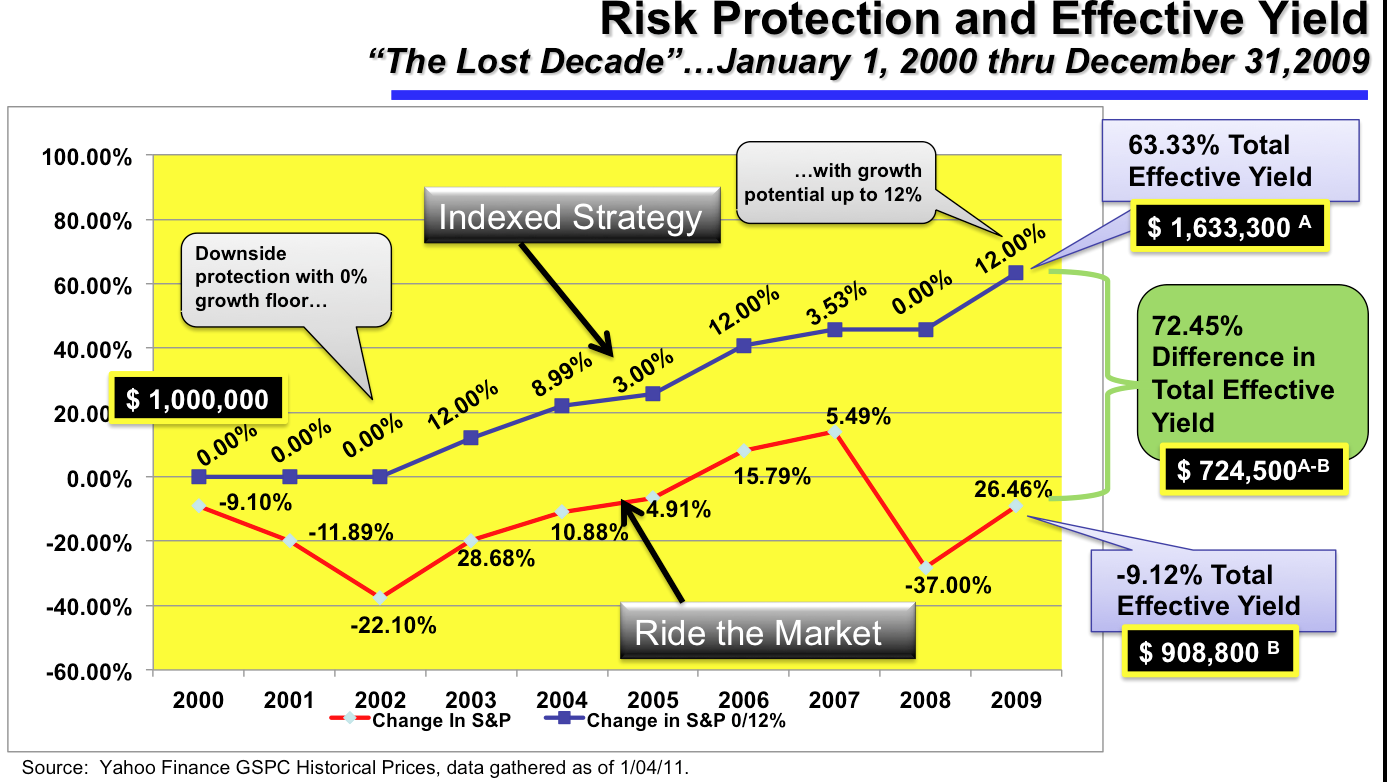

Let’s take a look at the “Lost Decade”…January 1, 2000 to December 31, 2009. $ 1,000,000 invested in the S&P including dividends on 01/01/2000 would have been worth only $ 908,800 on 12/31/2009. That represents a 9.12% loss.

$ 1,000,000 would have actually grown to $ 1,633,300 during the same period if annual gain/loss was subject to a 0% growth floor and a 12% growth ceiling. That is a 63.33% growth in value!

The difference in value between the two approaches is $ 724,500! See the chart below:

To learn more about our approach to presenting the potential value of an indexing strategy, please register and call us at 949-544-2500.